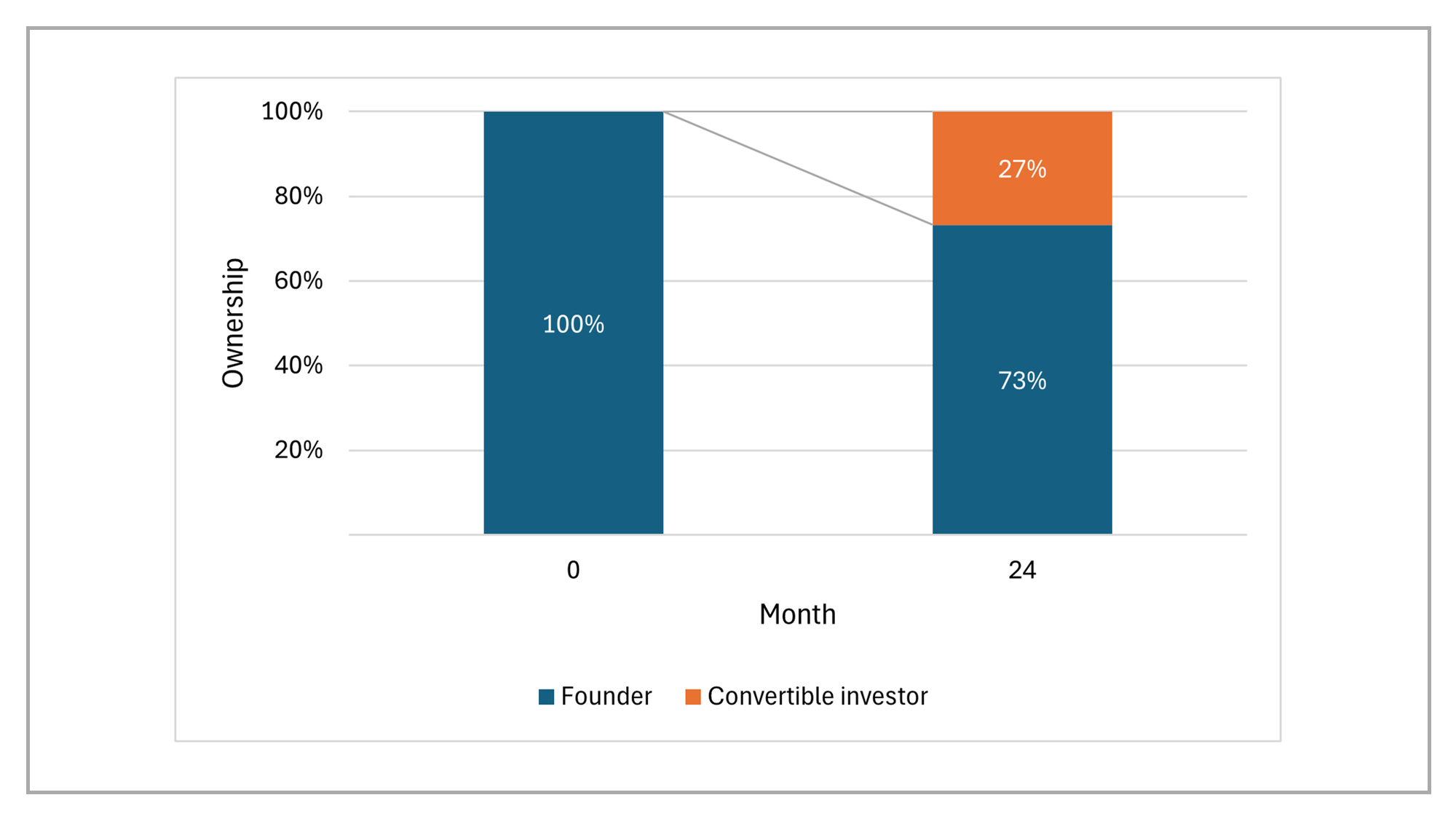

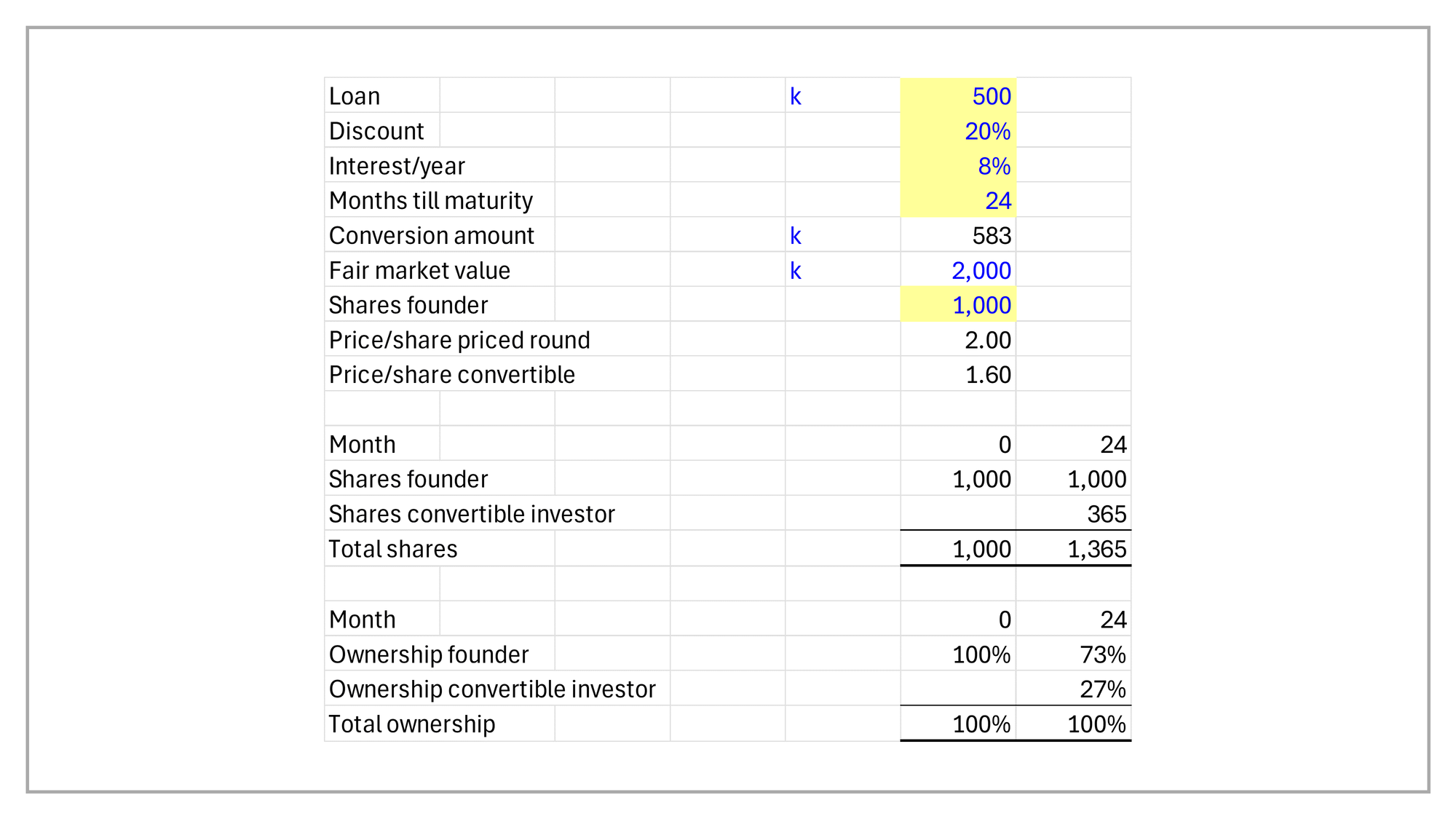

How much do I dilute if I raise 500k on a convertible with a 20% discount?

The convertible's term sheet: "In the event that no [Event of Default, Equity Financing or Liquidity Event] has occurred prior to the Maturity Date, the Loan plus accrued interest ("Conversion Amount") will be converted into that number of Conversion Shares equal to the result obtained by dividing the Conversion Amount by the result of the Fair Market Value divided by the Fully Diluted Capitalization immediately prior to the issue of Conversion Shares to the Lender multiplied with one minus the Discount."

So, with 8% interest/year, 24 months till maturity and 2m fair market value..

..I dilute 27%.